Computers adda

Telugu Video Tutorials – Notes – Shortcuts

Telugu Video Tutorials – Notes – Shortcuts

What is the Pre-Defined Ledgers?

Cash :- under the group cash in hand cash ledger created, where the opening balance can be entered as the books begin form.

Profit & loss :- this ledger is created under primary, where previous year’s profit or loss is entered as the begins form.

Difference between Tally ERP 9 and Tally 7.2 ?

Tally ERP has included many features includes Payroll Management, TDS and other Tax Features

Full form of BRS,GST, ESI, NEFT ?

BRS – Bank Reconciliation statement

GST – Goods and service tax

ESI – Employee state insurance

NEFT – National Electronic Funds Transfer

What is the Stock Journal?

A stock journal is used to transfer materials or stock from one location to another location is called stock journal.

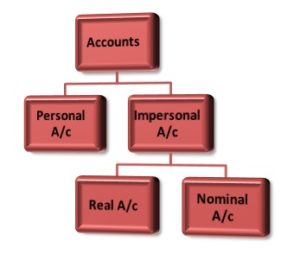

What are types of accounts and three golden rules of accounts?

Personal Account:-

This account is related to personal account principle.

Debit the Receiver

Credit the Giver

Real Account:-

This account is related to assets.

– Debit what comes in

– Credit what goes out

Nominal Account:-

This account is related to all expenses or losses normal incomes and gains.

– Debit all expenses

– Credit all incomes

Difference between capital expenditure and Revenue Expenditure?

Capital expenditure is for fixed assets, which are expected to be productive assets for a long period of time. Ex:- land, building, machinery etc…

Revenue expenditure whose benefit expire with same accounting year in which its assured. Ex:- sales, rent, telephone bill etc…

What is the Stock ?

Unsold item at the time of the period is called stock.

A What is Voucher ?

documents evidence is support of transaction is called voucher.